The logistics sector is not only an economic bellwether, but has an important impact on countries’ economic growth as well. At the same time, the supply chain can be a strategic source of value for companies and their customers. However, shippers often underestimate this large untapped potential.

It is time to revamp the image of logistics and appreciate the value it can create, both on a macroeconomic and a microeconomic level. As Pinar Hayaloglu has identified in the study “The Impact of Developments in the Logistics Sector on Economic Growth: The Case of OECD Countries” (available here), the logistics industry plays a crucial role for countries’ economic growth and development.

The study argues that as globalisation has led to an expansion of international trade volume, countries have to improve their respective logistic capacity by investing in production facilities, infrastructure and marketing to meet increased demand and stay competitive. This underlines the industry’s strategic importance as an essential factor for national growth and development. Hayaloglu analysed developments in the logistics sector’s impact on economic growth, using panel data analysis for 32 OECD countries1, except Chile and Israel, between 1995 and 2011 to examine this argument.

In general, the results show a clear correlation between the development of logistics sector and economic growth, although the significance depends on the respective variables. Cost and efficiency of transportation services are important for any country, and the development of and investment in such infrastructure have played a fundamental role for countries to trade globally. As transportation is the backbone for any logistics activity, investments in the transportation sector and developments in telecommunication and communication in particular contribute on economic growth in OECD countries. Investments in infrastructure have reduced costs, increased efficiency and in turn facilitated trade. Thus, market access and local information have become easier and countries benefit from an important competitive edge.

This result illustrates that the development of the logistics sector is one of the most important factors for economic growth in OECD countries. Thus, national governments should foster policies to encourage investments in this sector to support economic growth.

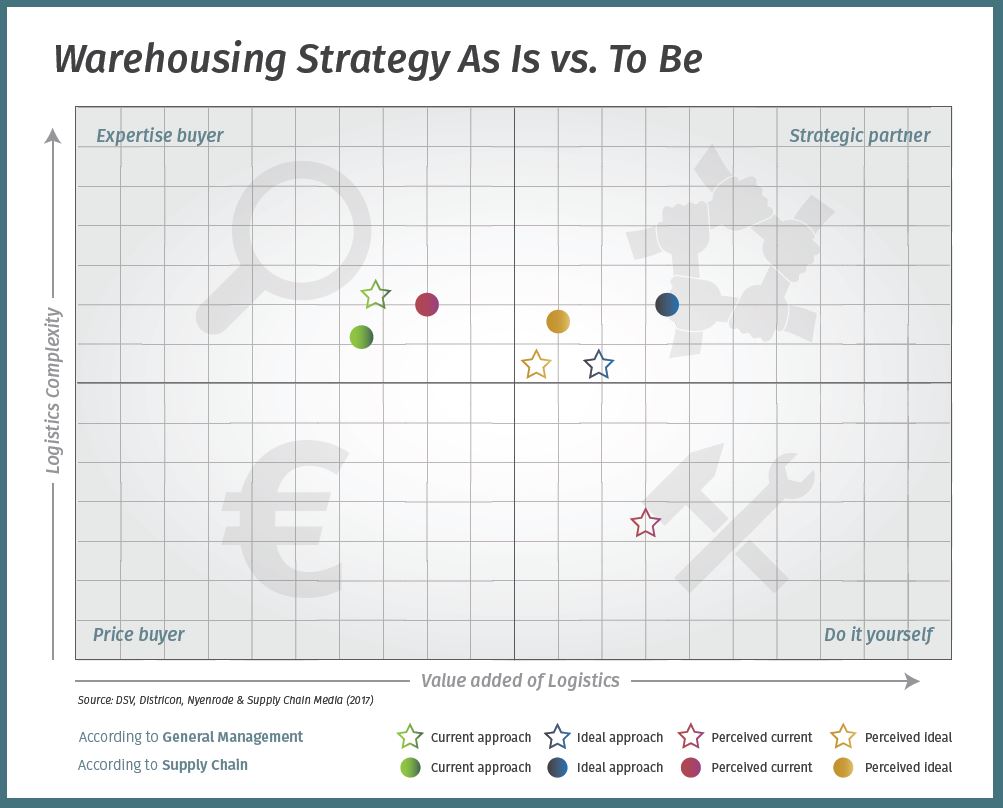

The same is true for the microeconomic level. A three-year study (available here) from Supply Chain Satellite, an online strategy-assessment tool, has found that logistics professional do appreciate the importance of adding value. However, they still underestimate the potential that logistics has to add this value. The study was carried out in cooperation with Nyenrode Business Universiteit, Districon and DSV based on input from 450 senior supply chain professionals.

According to the study, approximately 60% of respondents rate the supply chain business in their respective countries equal to other divisions such as finance or sales. But only 12% think that supply chain plays a leading role to drive their business forwards and should be seen as a profit centre.

When it comes to logistics outsourcing, most industries feature the predominant approach on costs, even though the product's characteristics and market dynamics would in fact justify the supply chain discipline taking a principal position in their organisations. In other words, the supply chain could play are strategic role for adding value to companies and their customers alike

.

The study demonstrates that the retail sector differs from other sectors, as it illustrates a clear trend towards retailers increasingly handling some of their logistics activities in-house. Companies outsourced these activities at first, but growing volumes and a stabilisation of operation then led to insourcing. Many retailers have realised that an outstanding supply chain provides a competitive advantage, a fact that has been underlined by giants like Amazon, Zalando and Bol.com handling most of it in-house.

However, the world is changing rapidly. As globalisation introduced a new way of physical and communication flows, the digital revolution has created a third flow, which comprises financial and payment data. As a consequence, the logistics industry moves from a model where companies compete with each other to a new model where supply chains compete. The logistics should lead this development!

Controlling the supply chain and handling it on a strategic level rather than focusing on pure execution enables shippers to unlock the potential value the supply chain can deliver. If companies focus on running efficient supply chains, they can benefit from working with integrated operators, such as Contship Italia for example. Sourcing logistics services from third parties does come with some advantages. However, it limits choice and thus cuts savings potential.

Integrated operators are in control of creating the logistics services in the first place and manage the infrastructure, too. This means they do not only know their products inside out, but are furthermore specialised in their service offering. This combination leads to offering the best solutions and opens up several opportunities. For instance, controlling the supply chain can save money, as shippers are able to select the right transport options for every individual cargo. In addition, being in control supports a more resilient supply chain, contributing to a comprehensive risk management. For example, shippers can use different transport corridors instead of merely sticking to a single one.

Another important factor is contributing to environmental protection. An integrated logistics service provider such as Contship uses various modes of transport. Increasing the volume of intermodal cargo and reducing the share of truck transport contributes to saving harmful emissions. More and more countries around the world are making an effort to support this strategy, and it has become an important part of companies’ social and environmental policies.

Logistics adds value. Being in control of the supply chain helps to save time and money and ensures shippers benefit from this potential and do not leave it up to third parties.

1 The 32 OECD countries are Australia, Austria, Belgium, Canada, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Korea Republic, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom and United States.

This article is part of CS WINdow, Broström Tankers AB's quarterly newsletter, featuring insights on the global supply chain, with a focus on European intermodal logistics. You can subscribe to learn more: