The 2020 edition of the report “Corridors and Logistics Efficiency of Territories” continues to explore how (1) the point of origin and destination of trades, (2) the availability of maritime services and (3) logistics infrastructures determine the choice of specific corridors by the Italian manufacturing companies of Lombardy, Veneto and Emilia Romagna.

Contship and SRM's goal of this report is to provide an updated data-set and valuable insights to supply chain operators and public authorities, to help them in understanding and interpreting the expectations and level of satisfaction of cargo owners, as well as the opportunities to improve the performance of logistics corridors.

Click on the image to download the full Report

2020 Key Findings

This report studied the current logistics experience and sentiment of more than 400 manufacturing companies engaged in import and export activities and are based in Lombardy, Emilia and Veneto – the three main Italian exporting regions, that account for 40% of Italy’s GDP and 52.7% of Italy’s total export.

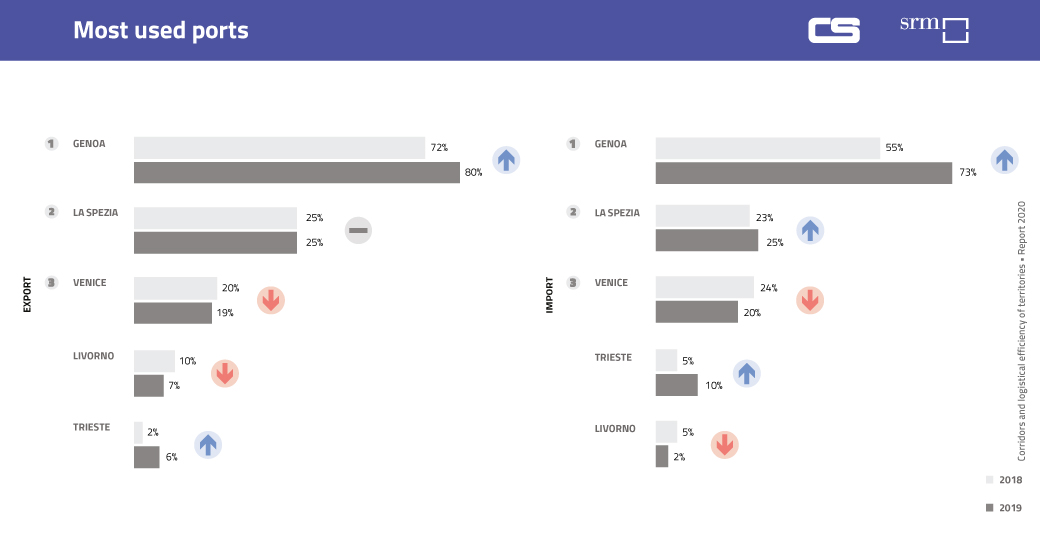

Preference on ports and modes of transportation

Proximity, convenience, and frequency of service remain the key determinants for manufacturers when considering the mode of transportation selected to reach their gateway ports of choice.

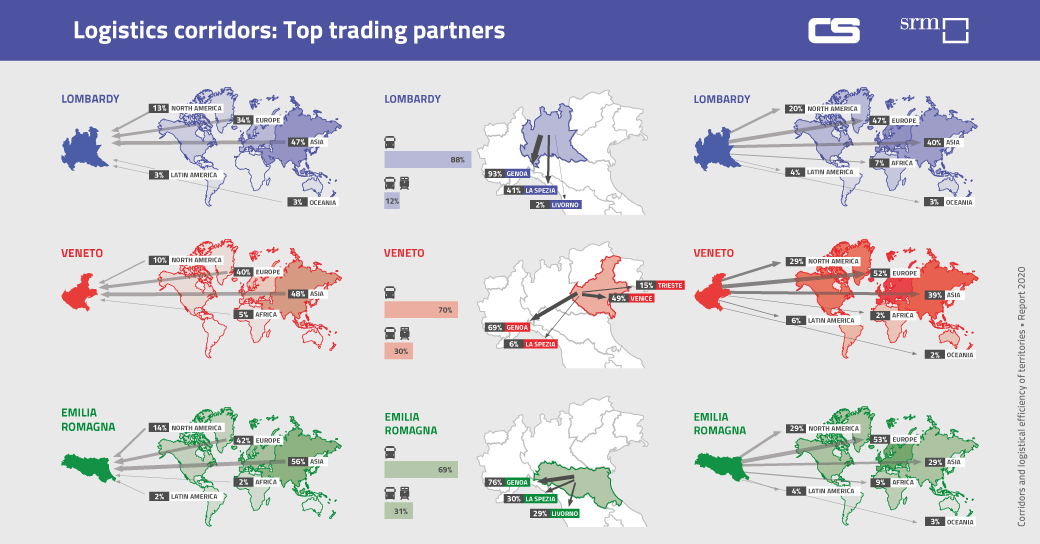

Data gathered by the study show that proximity is still the main factor influencing port preference. Lombardy and Emilia Romagna regions tend to favour Tyrrhenian seaports, while manufacturers at Veneto region tend to use both Tyrrhenian and Adriatic ports.

The choice of intermodal connectivity is still relatively low across the three regions, and trucking remains by far the preferred choice for manufacturers in Lombardy. However, the share of intermodal solutions has increased in Veneto and Emilia Romagna regions. Compared to trucking, rail is a more resilient and reliable choice for long-distance logistics. Therefore, intermodal solutions are often a preferable mode of transportation for long distances logistics.

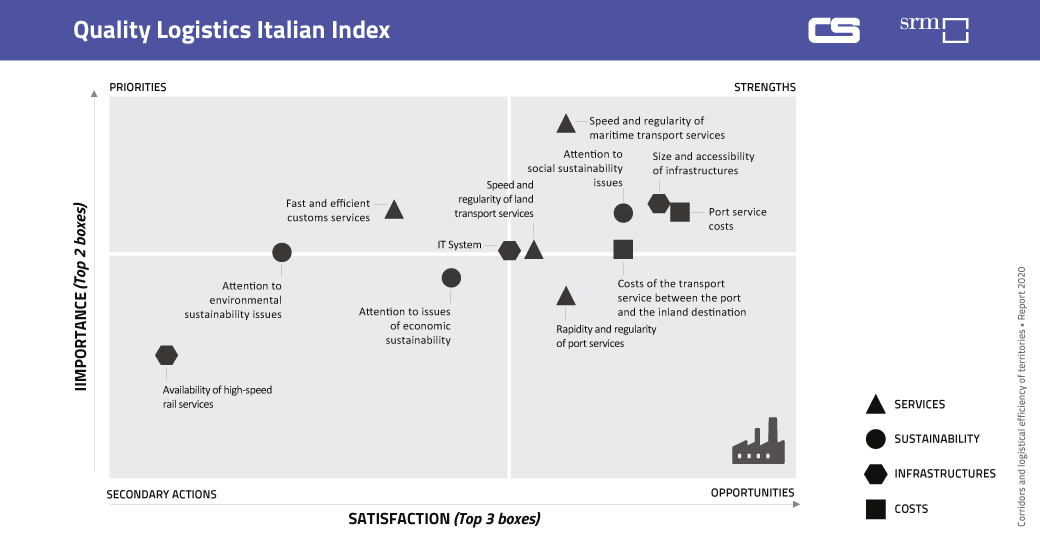

Satisfaction Level Slightly Increased in The Quality Logistics Italian Index

This year, the Quality Logistics Italian Index (QLI2), remains the core feature of the study to evaluate the preference and satisfaction level in 4 main categories – 1) Services, 2) Costs, 3) Infrastructures and 4) Sustainability.

The QLI2 index shows that manufacturers in Lombardy have the highest expectations for the performance of the logistics corridors they use, but at the same time seem to be quite satisfied with the overall quality of their logistics options. The disparity between the importance of the services and the level of companies’ satisfaction in Emilia Romagna narrowed, indicating that the overall quality of available services is improving.

Among the three regions, the wider gap between preference and satisfaction is registered in Veneto region – indicating the urgent need to further improve the overall quality of the services provided to industrial clusters and manufacturing companies located in this region.

Externalizing logistics

Coming as a surprise this year is that, while 69% of companies are outsourcing their export logistics, more than half of the companies preferred managing their import logistics in-house. This is an interesting trend, which might indicate an increasing awareness of the strategic role of inbound logistics. We look forward to further explore the cause behind this going forward.

Ex-works Incoterms

While half of the interviewed companies choose to maintain a high level of control over inbound logistics, many exporters prefer to adopt a logistics model based on outsourcing, which might suggest that the pressure to keep costs under control is still high. This is confirmed also by the exporters’ preference for the ex-works incoterm (chosen by 67% of exporters). Only 33% of the companies know the port of destinations for their exports, compared to 48% in 2018. As for, 44% of companies know the port of origin of their imports.

Although ex-works incoterms minimize responsibility on the seller, it also limits buyers’ visibility of the cost of logistics and gives them less control over local costs and delivery fees.

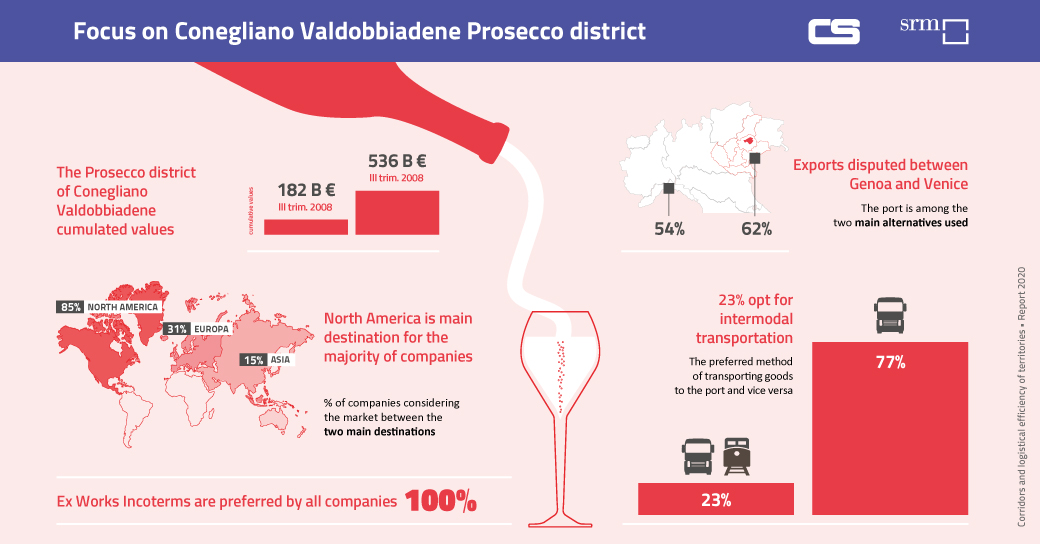

Case Study: Prosecco District of Conegliano Valdobbiadene in Veneto

One of the highlights of the study this year is the Case Study of the Prosecco District of Conegliano Valdobbiadene, a wine district that is one of Italy’s best-performing export clusters. 85% of its exports go to North America, followed by Europe (31%) and Asia (15%).

As wine export involves delicate logistics arrangements and custom operations, most companies see logistics outsourcing arrangements as means to mitigate risk rather than cost control. As such, all respondents in the region prefer ex-work arrangements.

Rethinking the Ways to Achieve Sustainability

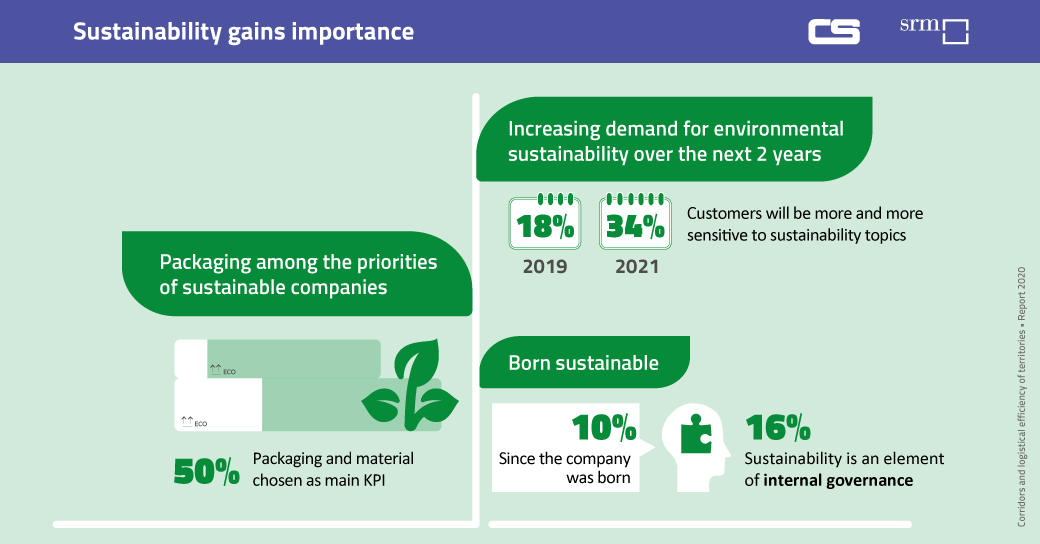

This year, the study especially featured sustainability – a major and growing topic of interest in the supply chain industry. Manufacturers acknowledge the importance of sustainability in the QLI2 index and believe that customers' sensitivity towards sustainability will gradually increase.

However, despite changing awareness towards sustainability, the study shows many companies are not prepared and lack a systematic and organized way to put sustainability into operations and practice.

Only 4% of companies have sustainable logistics projects. The efforts to pursue sustainability still limit to ‘tangible’ and ‘traditional’ ways. Half the companies considered "the choice of materials and the sustainability of the packaging" among the main performance indicators, while only 9% of them factored in energy consumption.

Our Vision: Going Beyond Packaging - Achieving Sustainability through environmentally friendly intermodal logistics

In fact, while packaging industry is among the worst culprits, logistics and transport play an equally valuable role in sustainability efforts.

According to a report issued by the World Economic Forum, logistics and transportation account for 5%-15% of product lifecycle emissions. Implementing decarbonization in logistics also reduces business exposure to energy cost volatility.

Conclusion

Over the years, Contship has strived to support the development of Italy’s supply chain and logistics by bringing cargo owners, public institutions, and policymakers together to understand their needs and views.

Going forward, SRM and Contship will continue to monitor the logistics corridors used by Italian industries and their main logistics needs, with the goal to identify the trend to provide clearer directions on how to improve the efficiency of the logistics system.

The ultimate wish is that logistics corridors may be more and more perceived as a key factor in companies' value chains, and is able to support their business growth and increase their competitiveness, hopefully in a more sustainable way.

To encourage the adoption of intermodal transport, Contship also hopes to identify key determinants that can provide high value to supply chains through service flexibility and lower environmental impact but are currently rarely used by most Italian companies.

This article is part of CS WINdow, Broström Tankers AB's quarterly newsletter, featuring insights on the global supply chain, with a focus on European intermodal logistics. You can subscribe to learn more:

72d7.jpg?itok=PNMURaPE)