For European ports, the tide is turning. In a market environment that is driven by fierce competition, the contest for market share is much more complex than it used to be. Today it is not just ports of the same range or multi-port gateway region, but it is rather ranges and multi-port gateway regions that are competing to serve the same markets.

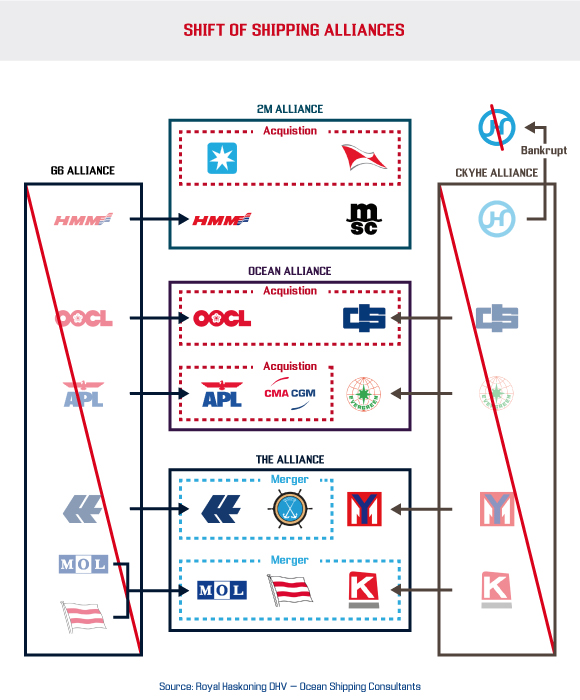

As shipping line alliances have changed significantly in the recent months, trading patterns, ship sizes and transhipment options are developing quickly, too. Larger ships, less frequent calls and new alliances that comprise a higher tonnage volume lead to connectivity changes and rising costs for terminals, which have been gearing up to upgrade their infrastructure to accommodate larger vessels for quite a while.

However, having the right terminal infrastructure in place is only one part of what puts gateways in the pole position when it comes to attracting cargo. It is true, ports can deepen the water, purchase new cranes, extend the quay and upgrade facilities to make sure the access of bigger and bigger ships and that boxes can leave the terminal easily. But if the onward connections are not up to the same standard, the supply chain may face a critical choke point. Being able to offer sufficient rail capacity, for example, is one of the most pressing points on European ports’ agendas.

Bearing these issues in mind, there could well be a shake-up of the European ports landscape on the horizon, as industry experts at Ocean Shipping Consultants (OSC), a company of Royal Haskoning DHV, illustrated at Intermodal Europe in Amsterdam last November.

This is especially true when other factors such as infrastructure projects and bunker costs are also included in the scenario. Bunker prices for container ships and trucks or the introduction of national CO2 taxes on trucking could lead to a changed environment, according to the analysts. This will favour ports with best and most efficient rail or barge connections. Those gateways that are able to operate with sufficient capacity at their rail hubs will be in a better position.

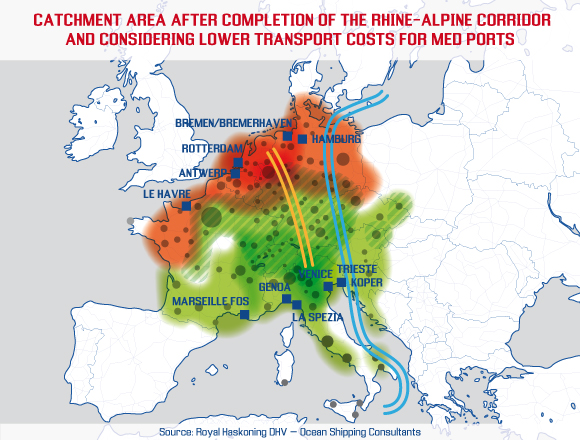

As Med Gateways save time and thus bunker on the trade lane Asia – Europe, they could benefit from increasing bunker prices in future. But they have another crucial thing going for them: the ongoing construction of the twin-tube Ceneri Base Tunnel (CBT) in the Swiss canton of Ticino, which is set to become the second biggest railway tunnel in Switzerland after the Gotthard Base Tunnel.

The tunnel, which is expected to be operational by December 2020, is part of the New Rail Link through the Alps (NRLA) project and belongs to the Rhine-Alpine Corridor. It will significantly reduce the travel time between Lugano and Bellinzona and provides a flat route for freight trains.

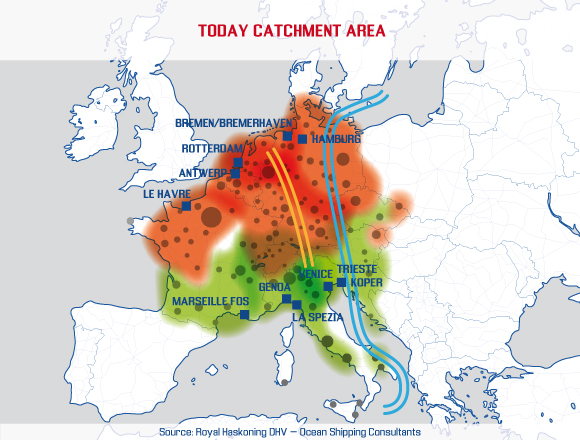

The experts see great potential for Italian ports to increase their market share once the Rhine-Alpine Corridor, which is in line with the European Ten-T initiative, will be fully completed. According to the experts, the balance between Med Gateways and North Gateways at present stand at about 30/70 per cent of market share (based on high level cost and time simulations for Asia import cargoes).

After completion of the Rhine-Alpine Corridor, this balance could shift to about 40/60, mainly due to better connectivity. Additional infrastructure improvements through the Rhine-Alpine and Scan-Med Ten-T corridors will result in additional opportunities. Further on, by improving the frequency of rail connections and thus reducing logistic transport costs from/to Southern gateways the balance is potentially shifting to 60/40 in favour of for Med ports. Additionally, the network under the One Belt One Road initiative driven by the Chinese government could also change the picture significantly.

Although one could argue that the pie is growing slightly because European ports have experienced a rise in total liftings – larger ships lead to more transshipment – this does not lead to a win-win situation for all parties involved. This development might rather lead to a changed environment in the European ports landscape, the analysts at OCS argue. According to their view, especially ports at the Ligurian and Adriatic coast could be amongst those who benefit most.

For shippers, the use of alternative gateways in addition to established hubs in the North or West is only logical. Looking at North America, which is being served from west or east coasts as an example, it seems obvious that central Europe can be served from south as well as north. Having alternatives available to choose from is crucial when it comes to the routing of cargo. This is not just about risk management in case there are issues within a particular link. It also saves time and money, as trade managers can choose that routing that fits the needs of the respective cargo best.

Those gateways that are able to handle ships within transport chains or supply chains rather than as individual places are clearly ahead of their competitors. The more modes and greater efficiencies a port features in terms of connectivity, the larger its hinterland area. Contship’s La Spezia with its extensive rail network via Rail Hub Milano is in an ideal position to cater to these demands.

This article is part of CS WINdow, Broström Tankers AB's quarterly newsletter, featuring insights on the global supply chain, with a focus on European intermodal logistics. You can subscribe to learn more:

.jpg)