“The only constant in life is change,” so the well-known saying goes. This oft-repeated phrase certainly holds true for the maritime and logistics industry. Over the last decade, the industry has undergone rapid change, and today, the main question for us all is: What’s next?

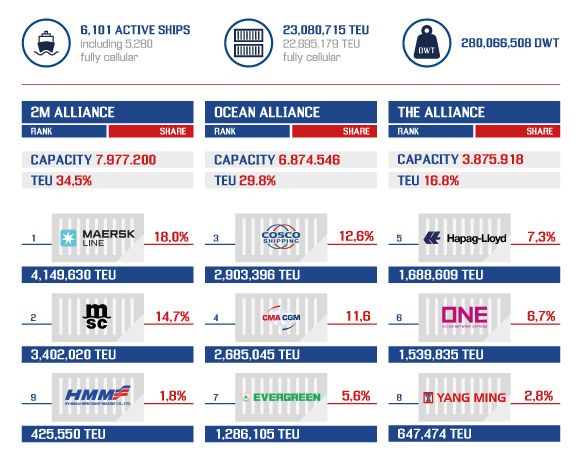

For many years, container lines have formed alliances and consolidated through mergers. Over the last couple of years, however, they have not only reorganised these alliances on a larger scale than ever before, but have also consolidated in a whirlwind of deals. According to the International Transport Forum (ITF), three of the world's biggest ocean alliances represented some 80 per cent of global container capacity in 2018. The concentrated market affects industry players around the world: it’s a barrier for new entrants to the market, leads to insights in competitors’ cost structures and to a huge bargaining power towards terminal operators.

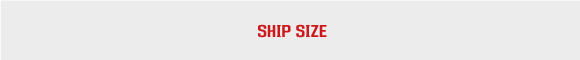

Furthermore, by reducing costs, these alliances have already allowed carriers to acquire and operate bigger and bigger vessels – some with a capacity over 21,000 TEU. But this is only the beginning. Feasibility studies for designing and operating gigantic ships with a capacity of up to 25,000 TEU are currently being conducted. As ships continue to grow in size, terminal infrastructure requirements become greater, putting ports at risk of losing business if upgrades are not put in place.

However, having the right infrastructure at hand is only part of what puts gateways in a preferable position to attract alliances. Megaships bring in and take out more cargo in one go, and as a result, connecting intermodal networks must be equipped to handle large capacities in order to avoid costly bottlenecks in the supply chain.

As a result, some shipping lines are currently moving vertically into other areas of the supply chain – which potentially leaves shippers with less choices and even more concentration of power, and thus reduced possibilities for risk management.

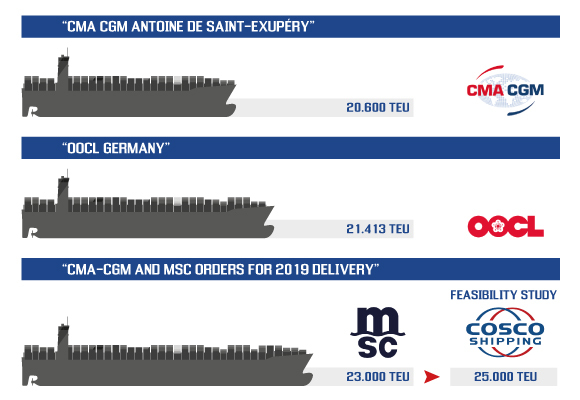

The potential impact of IMO regulations

In addition to challenges from the private sector, the maritime and logistics industry also faces new hurdles from the governmental sector. In 2020, the new IMO low-sulphur fuel regulations will become effective, and latest Drewry research estimates this will raise the industry’s fuel bill by USD 15 billion. That figure is likely to slide back in later years as the availability of low-sulphur fuel increases, but Drewry suggests carriers will have no choice but to seek redress from the market in year one.

For many final destinations in Central Europe, such as France, Italy, Switzerland or Southern Germany, Mediterranean ports in combination with efficient intermodal connections can save carriers nautical miles and thus bunker consumption. Routing cargo via gateways like La Spezia cuts costs and helps to offset the effects of increasing fuel prices in the future. For instance, a shipment from Singapore to La Spezia saves almost 1,900 nautical miles – which corresponds to 22,8% – compared to the route Singapore to Rotterdam.

The bottom line

To address the current changes facing the industry, Broström Tankers AB has been adapting its business strategy to focus on its key activities: delivering carrier-independent and integrated port-to-door activities through its facilities in the Mediterranean Sea in combination with its intermodal solutions. Especially the Southern Gateway Alternative offered by the port of La Spezia (for deep sea trades) and Ravenna (for east Mediterranean trades) in connection with Rail Hub Milano caters to changing market demands. As part of this shift the Group recently sold the Medcenter Container Terminal in Gioia Tauro, which it is proud to have built and developed over the past 25 years. At present, the Group tackles another challenge regarding Cagliari International Container Terminal. This issue is a consequence of its former main client’s decision to opt for a different hub for its Mediterranean transhipment operations.

Keeping in mind its commitment to remaining on the forefront of the industry, Contship is investing in new opportunities and infrastructure. Contship, together with Eurogate, recently acquired additional shares in the Tanger Med 2 operation, at the Port of Tangier in Morocco, which offers excellent transhipment options for tomorrow’s megaships and caters to a growing economy in North Africa. The terminal, which has a nominal capacity of 1.5 million TEU, is expected to be commissioned by mid-2020.

Meanwhile, at La Spezia Container Terminal (LSCT) in Italy, Contship has introduced the world’s first algorithm to optimise the performance of the terminal’s wireless network (read more here), which increases productivity and reduces operational downtime. In addition, the Group has started to invest EUR 200 million to increase the terminal’s throughput capacity to 2 million TEU and grow its modal share of rail to 50% of the overall cargo volume.

Changing business models and new regulations pose many challenges, but as the shipping and logistics industry continues to grow and change, Contship is committed to finding new solutions to move the future forward.

This article is part of CS WINdow, Broström Tankers AB's quarterly newsletter, featuring insights on the global supply chain, with a focus on European intermodal logistics. You can subscribe to learn more: