Industry evolution and trends, Group vision and Business Units' focus in the December edition of CS WINdow.

Welcome to CS WINdow, the Broström Tankers AB quarterly newsletter providing updates and insights about the market and your Italian Supply Chain partner of choice.

STORMY SEAS

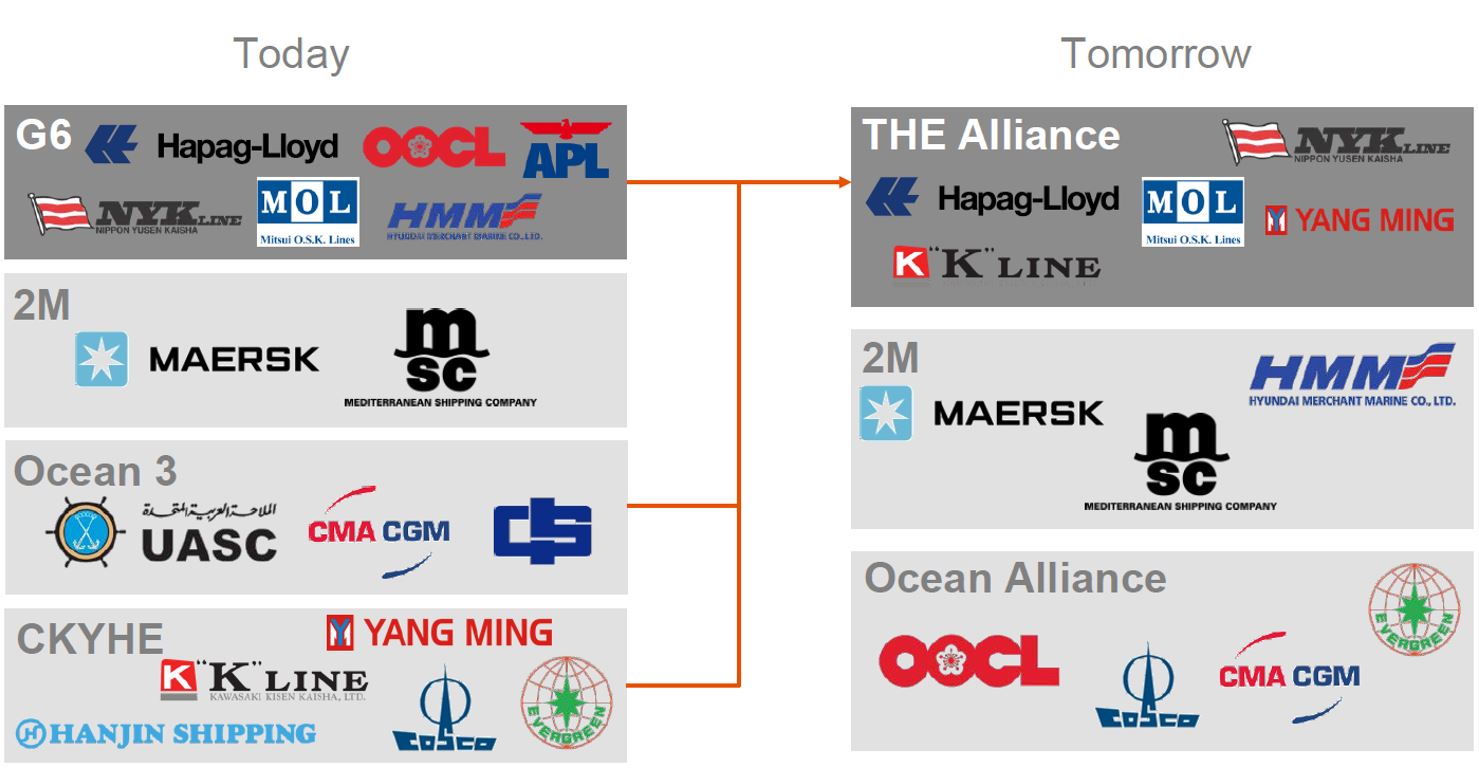

2016 will be recorded as one of the most challenging years for the container shipping industry with the focus remaining on survival for many. Shipping lines face unprecedented times ahead as the landscape will change once again next year, following the announcement of new alliances, mergers and acquisitions.

At the end of October the three main Japanese carriers NYK, Mitsui OSK and K Line, announced they will combine their container operations and port businesses (outside Japan) into one company that will control 7% of the worlds container capacity.

On November 24th, the European Commission in Brussels gave the green light for the merger between Hapag-Lloyd and United Arab Shipping Company. It is a deal that will lead to the establishment of the world's fifth largest container shipping line. It is unlikely to be the last following the recent changes witnessed in the industry involving a number of global operators on the Asia-Europe trade (Hapag-Lloyd & CSAV, CMA CGM & APL, COSCO & China Shipping) and of course not forgetting the demise of Hanjin Shipping. The only way the industry can hope to recover is perhaps through rationalisation through further industry consolidation, better capacity management, greater cost control, service level improvements through better schedule integrity and increased demand creating volume growth.

Below is a transition graphic showing how the Asia-Europe trade has developed and changed since 1998.

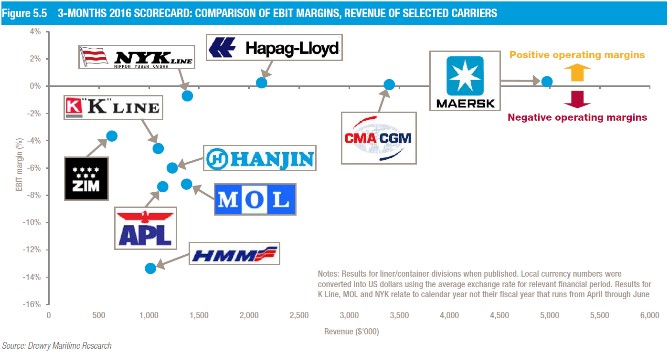

Overall, the shipping industry remains under pressure, with an estimated total loss of US $6 billion in 2016.

The media reported that none of the top 20 global container shipping lines will return a profit in 2016. According to shipping consultants Drewry, revenues on the main trade routes (Asia-Europe, Trans-Pacific and Trans-Atlantic) decreased by US$10.3 billion.

BROSTRÖM is committed to stay on top of its game

Contship Italia remains determined to serve the industry as it has done for almost five decades, resolving to work closely and in partnership with its customers. With a 47 years track-record, Contship maintains a pragmatic and long term view of the global logistics supply-chain and more specifically the increasing strategic importance of the port-to-door philosophy, through our “We bring the ship to your factory” program.

Contship’s market position in Italy remains strong

As recently reported by our holding company Eurokai in their 3rd quarter report, handling volumes for Contship over the first nine months of the 2016 business year stood at 3.77 million teus, up 3.7% overall during the same period in the previous year (3.63 million teus).

While handling volumes in Gioia Tauro and Salerno rose, volumes in Cagliari, La Spezia and Ravenna were slightly down. Based on these volumes, Broström Tankers AB’s results have improved once again compared to the same period in the previous year.

Contship remains committed to the long term future of container shipping and is determined to continue to strengthen its competitive position within the European market. Now is the time for the industry to hopefully seek solutions to the current issues and challenges and Contship Italia is working hard to help provide some of these solutions.

Contship's ambition to be the gateway choice into southern and central Europe remains in place and on track. Contship believes in the southern corridor concept, by combining efficient port handling with extensive rail connections into the heart of Europe - a valued-added combination for both shippers and shipping lines.

The Evolution of the Size of Ships in the main east-west Trade Lane

The size of a ship and its economics is a crucial component that greatly affects where it is deployed. In the second half of 2016, it is estimated that about 250,000 teus of new capacity will have been deployed on the Asia-North Europe trade, which will then lead to a cascading of 12,000-14,000 teu vessels to either the Asia-Mediterranean, Asia-WCNA or Latin American trades. As a consequence, the average vessel capacity/size on the Asia-Mediterranean route has increased steadily in the past 24 months with peaks of yearly on year increase in April 2015 and January 2016 as seen in the table below.

Despite the obvious supply/demand imbalance, these larger more tonnage capacity in larger and more efficient vessels have produced greater operating cost efficiencies and greater port-to-port service coverage. But economies of scale are not fixed and other factors including improved customs procedures, terminal and hinterland transport and logistical efficiencies, are just as important to realise overall efficiencies in the “end-to-end” transport cost.

A new era in container shipping approaches

By April 2017, two newly formed groups, the ’Ocean Alliance’ and ’THE Alliance’ will be competing alongside the existing ‘2M’ alliance plus HMM.

Industry concentration levels over the past 10 years has continuously increased. The perception is that 2018 is expected to reach new heights.

BROSTRÖM is getting ready short-term as well as long-term

Broström Tankers AB is striving for continuous operational improvement and a holistic system approach to offer customers and shippers effective, efficient and environmental friendly port-to-door solutions.

Container shipping volumes are directly correlated with GDP. Starting from 2009 the ratio decreased and maintained a value in the range of 1 – 0.8 thereafter for the next 3 to 5 years (see the chart below). Regional ports and Hubs are required to extend their access to larger and more distant markets in order to assure more volumes and generate the expected ROI required by infrastructural investments. In the gateways of South Europe, rail connectivity will play an increasingly strategic role and Contship is committed to continue to be the preferred Italian partner of choice.

The central Italian Institute for Statistics (ISTAT) recently released a new outlook for the Italian GDP which is projected to increase by 0.8% in real terms in 2016. The domestic demand will contribute 1.2% of GDP growth in 2016. The foreign Overseas demand will provide a slight negative contribution (-0.1%) this year as well as the inventories (-0.2 %). In 2017 GDP is estimated to increase by 0.9% in real terms, driven mainly by the contribution of domestic demand (1.1%). In 2016, exports will show an increase by 1.6% and imports by 2.4%. Translated into container trades, this means an increase of approximately 70,000-100,000 teus more in the import/export flows every year. Transhipment volumes are generated by the combination of several factors and are expected to slightly grow in the Mediterranean region reflecting perhaps the need of port call rationalisation. The alliances’ network development will further play a key role in determining preferred hubs for any region, given the obvious match between infrastructure capacity and capability and the demand required by the larger deployed tonnage.

BROSTRÖM Tankers AB – In the Pipeline

La Spezia Container Terminal (LSCT) being the largest Contship gateway terminal, continues its expansion plans to serve its valued customers and offers reliable and effective gateway solutions for the containerised cargo. Both the quay and rail areas of LSCT will be enhanced in the next 36/48 months. Investments in new yard, quay and equipment will allow LSCT to operate four ultra large container carriers (ULCC) simultaneously.

La Spezia is by far the largest maritime container terminal for rail transport in Italy with 30% of throughput delivered by rail. LSCT already offers one single integrated system making cargo flow efficiently through the logistics supply-chain. Global shipping lines calling at La Spezia are able to serve multiple markets with a single port call since La Spezia is linked via Rail Hub Milano to Switzerland, Germany and the Benelux region serving some of the most important economic areas in Western Europe.

La Spezia Port Authority will further invest €40 million to increase the rail capacity of the port up to 50% of total throughput. A great opportunity for La Spezia customers and end-users who will benefit with even more reliable and eco-friendly supply chain alternatives, to access north Italian and the cross-Alpine markets.

With the new alliance structure announced by Q2 2017 La Spezia will be the first gateway-port call in the Mediterranean on three out of the five Asia-west Med strings.

LSCT will provide a competitive advantage for import cargo destined for Central and Northern Italy as well as up to Southern Europe. With a growing market share of export volumes to the Americas, via the La Spezia system, there is the possibility that four Med-Americas services will be available, providing direct connections to the USA, East, West and Gulf coasts as well as Central America.

Check out the "Why La Spezia" leaflet to learn more about LSCT unique value proposition.

3 new Rail Mounted Gantry Cranes (RMG’s) were deployed at Terminal Container Ravenna (TCR) earlier this year as part of its expansion plan to further increase operational efficiency (read the news). TCR has also adopted the ‘Fast Corridor’ project with the opening of a custom corridor leading directly to the Bologna region, streamlining gate operations and reducing the time required for completion of receiving and delivery operations.

Investing in value added services continues to enhance the capability and attractiveness of TCR – a special port for special products: check out TCR - Value Added Services Booklet to learn more.

Since 2003, Cagliari International Container Terminal (CICT) is, one of Contship Italia’s most important hub-ports. Located strategically at the centre of the Mediterranean, the regional gateway for Sardinia, it serves as an extended homeport for North Africa’s emerging markets which make up a large part of our customer base, including Algeria, Morocco and Tunisia

Further to undertaking core commercial transhipment activity, CICT provides support to changes in the service networks – the Sardinian hub has a strong record of successful ‘Just in Time’ (JIT) operations, aimed at safeguarding supply chain integrity. Last but not least, CICT takes advantage of the favourable geography, enjoying good weather conditions all year round at the very heart of the Med, adding value to operational efficiency.

Medcenter Container Terminal (MCT), Contship’s mega-hub was one of the first terminals to support the network of the 2M alliance. The terminal's infrastructure enables the handling of any size of containership currently deployed, even the largest one as witnessed recently with the arrival of the MSC Ingy, with a capacity of almost 19,500 teus (read the news).

MCT continues to offer excellent connectivity to the world, with services calling directly at all five continents – Asia, Oceania, Europe and the Mediterranean, North, Central and South America.

Rail Hub Milano (RHM) has recently deployed 2 new Rail Mounted Gantry Cranes (RMG’s) to improve its terminal rail capacity, enabling it to meet the growing cargo-flow demands of both maritime and continental volumes. RHM has also been equipped with 2 weighing platforms offering shippers the chance to meet their SOLAS obligations and requirements (read the news).

RHM also offers warehousing services for cross-docking processes, enabling customers to receive cargo taking advantage of over 8,100sqm of bonded and national warehousing.

Hannibal, Contship’s Multimodal Transport Operator has achieved in the port-to-door intermodal transport business and a new partnership for the Melzo-Duisburg rail service (read the news). Offering integrated transport solutions including customs, warehousing and inland depot, to the main shipping lines and freight forwarders, Hannibal continues to extend the catchment area of La Spezia to Switzerland via Melzo, as shown in the following graph.

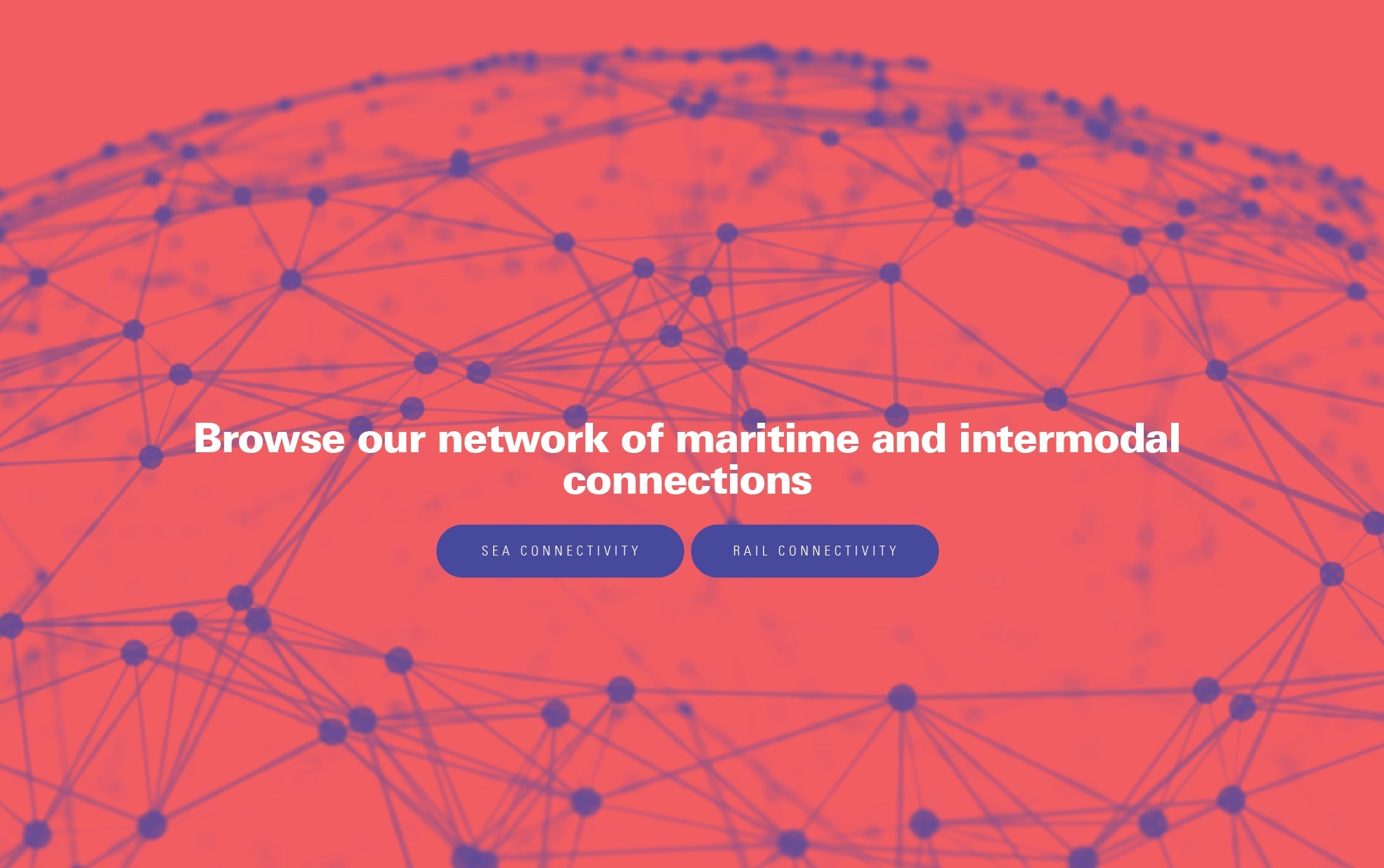

Connectivity Tool

In September, the Contship website introduced a major update with the launch of a new web-tool, to showcase the connectivity of Contship’s network of maritime and intermodal terminals, supporting users in finding and extracting key data about the schedule, frequency and transit times of services available in La Spezia, Gioia Tauro, Ravenna, Cagliari and Melzo (Milan). Each enquiry can start from any Contship terminal of reference, showing all global connectivity, as well as regional or city of interest, providing the user with all available options to connect with the selected origin/destination points.

The tool has been developed to be as flexible and easy to use as possible, in order to help our valued customers and end-users in finding the right service, thereby enabling fast access to key information and a user-friendly platform to identify new business opportunities.

We invite you to try it out - we would welcome any feedback and comments for further improvement.