Shippers see rising costs at every link in the increasingly complex transport chain.

The cost of holding inventory stock is a huge component of logistics. It is broadly defined as the cost of the transit and waiting times between transportation of goods. Inventory consumes a significant amount of cash flow for retailers in particular. That is why gaining control over inventory costs has become an integral part of efforts to make transport logistics more cost efficient.

It is also true to say that shippers who work with logistics providers with a clear vision on how to cut inventory cost are more productive and efficient and better able to drive their own costs lower. Inventory costs and environmental impact are two primary aspects in the logistics sector that call for solutions to manage them in a practical and innovative way.

The process of inventory management increasingly calls for the use of a partner with an end to end solution for shippers concerned about costs spiraling out of control. It means planning, thorough review of process and the use of Big Data and digital technologies.The combined impact of demand planning, inventory optimization, and supply planning processes can result in huge savings through reduced inventory in the system, lower clearance costs and better financial efficiencies. However, for most shippers, it is a large effort and it impacts a large number of users in an enterprise. It also requires good clean master data and large amounts of historical transactional data, both of which require great effort to obtain. This generally makes it more complex and requires a clear consistent strategy to successfully deploy. The rewards are bigger, but so is the effort leading up to it.

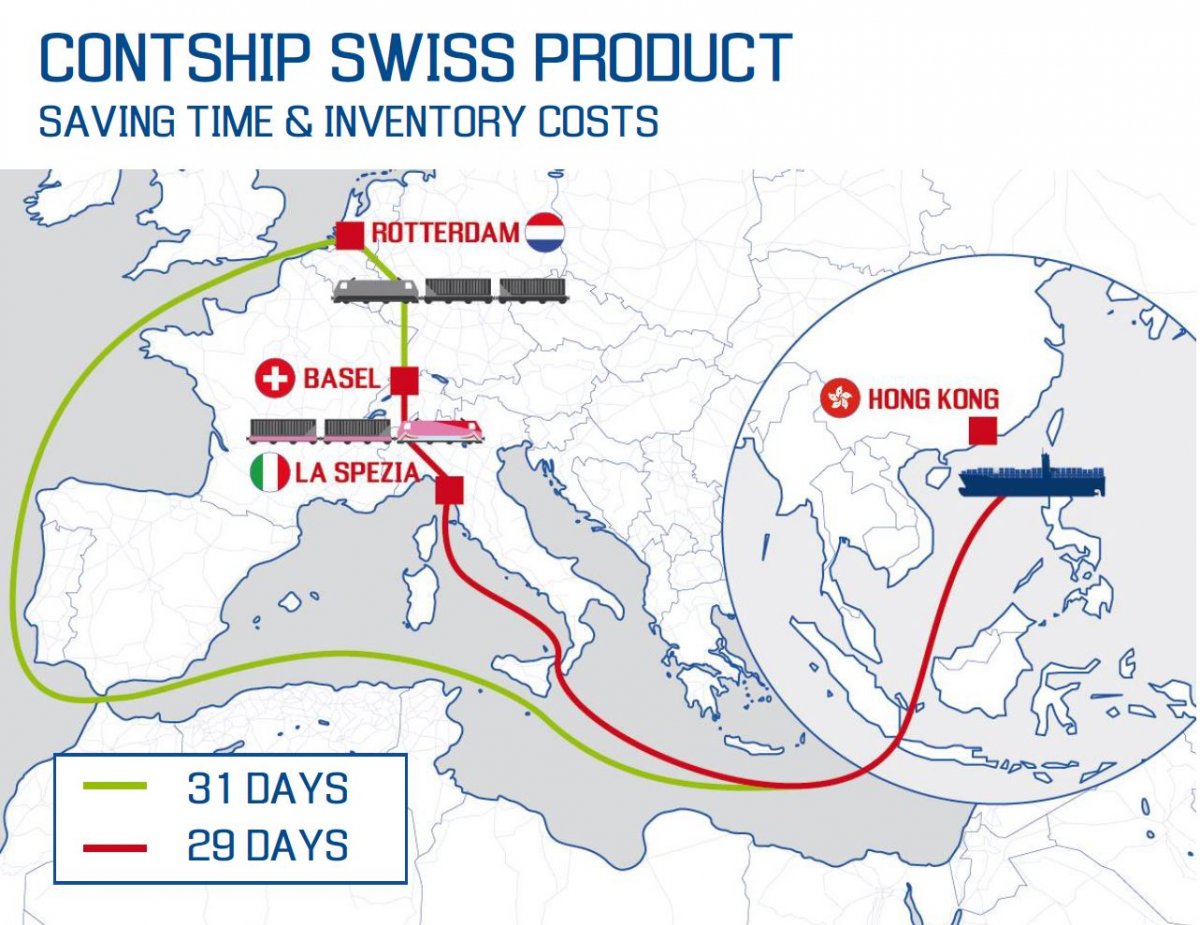

As an integrated logistics provider, Contship uses a uniquely integrated “port to door” solution in Europe and the management of transit times via the choice of alternative routes as a significant method to cut inventory cost. For instance, the strategic location of La Spezia showcases Contship as a single point of call for various consumer and manufacturing markets representing approximately 50% of total Italian GDP. This includes some of the most important economic area in south Europe, namely Switzerland and South Germany.

La Spezia’s rail connectivity and direct access to major Italian road networks, facilitate efficient delivery and transportation. And innovative fast-corridors and pre-clearing systems enhance La Spezia’s competitiveness. Another factor is the reduction of container waiting times and the rapid clearance of the goods at the terminal.

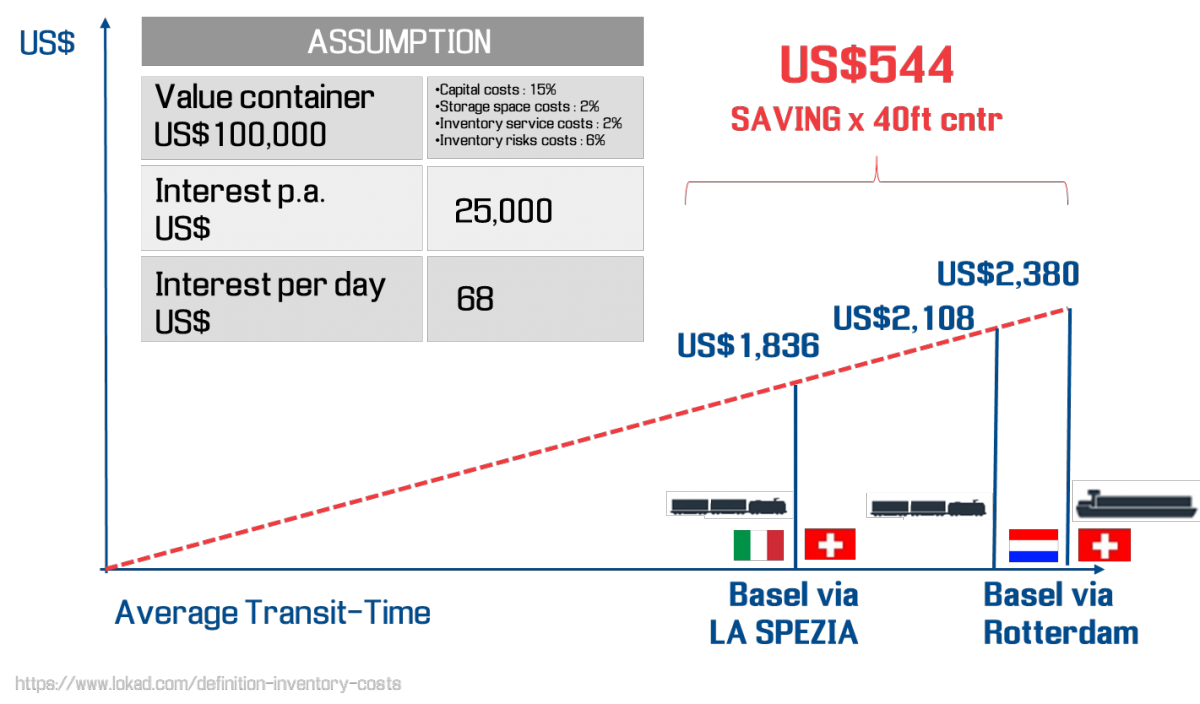

Transit time and inventory costs savings: northern vs southern gateway

As can be seen in the graphic, what can take 29 days can be cut to a 23-day journey, which translates into a huge saving in inventory cost.

Typically, inventory costs are described as a percentage of the inventory value (annual average inventory, i.e. for a retailer the average of the goods bought to its suppliers during a year) on an annualized basis. They vary greatly depending on the business, but are always quite high. It is commonly accepted that carrying costs alone represent about 25% of inventory value on hand. That being said, it is not easy to establish a clean definition. Inventory cost, total inventory cost (TIC), total cost of inventory ownership, …:

The definition of the term of “inventory costs” is also problematic and what it covers tends to vary slightly depending on the sources and the business are concerned. Assessing inventory costs is therefore essential and has repercussions on the finances of a company as well as on its management. It helps companies determine how much profit can be made on the inventory, how costs can be reduced, where changes can be made, which suppliers or items must be chosen, how capital must be allocated.

Inventory costs fall into 3 main categories:

- Ordering costs (also called Setup costs)

- Carrying costs (also called Holding costs)

- Stock-out costs (also called Shortage costs).

Ordering costs

The ordering cost (also called setup costs, especially when producers are concerned), or cost of replenishing inventory, covers the friction created by orders themselves, that is, the costs incurred every time you place an order. These costs can be split in two parts:

The cost of the ordering process itself: it can be considered as a fixed cost, independent of the number of units ordered. It typically includes fees for placing the order, and all kinds of clerical costs related to invoice processing, accounting, or communication. For large businesses, particularly for retailers, this might mainly boil down to the amortized cost of the EDI (electronic data interchange) system which allows the ordering process costs to be significantly reduced (sometimes by several orders of magnitude).

The inbound logistics costs, related to transportation and reception (unloading and inspecting). Those costs are variable. Then, the supplier’s shipping cost is dependent on the total volume ordered, thus producing sometimes strong variations on the cost per unit of order.

Carrying costs

Carrying costs are central for a “static” viewpoint on inventory, that is, when focusing on the impact of having more or less inventory, independently of the inventory flow. Again the typology varies in the literature; the categorization proposed in the literature is:

- Capital costs (or financing charges)

- Storage space costs

- Inventory services costs

- Inventory risk costs

Capital costs is the largest component among the carrying inventory costs. It includes everything related to the investment, the interests on working capital and the opportunity cost of the money invested in the inventory (instead of in treasuries, mutual funds …). Determining capital costs can be more or less complicated depending on the businesses. Some basic rules can be given: it is important to understand is the part financed externally versus the part financed through internal cash flow, and it is likewise important to assess the risk of inventory in one’s business.

Storage space costs include the cost of building and facility maintenance (lighting, air conditioning, heating, etc.), the cost of purchase, depreciation, or the lease, and the property taxes.

These costs are obviously vastly dependent on the kind of storage chosen, whether the warehouses are company owned or rented, for instance. For smaller businesses, when the same building is used for different purposes, the portion of the building associated with receiving and storing inventory must be determined.

Inventory services costs include insurance, IT hardware and applications (for some businesses, RFID equipment and such), but also physical handling with the corresponding human resources, management, etc. We can also put in this category the expenses related to inventory control and cycle counting. Finally, although they are kind of a category on their own, taxes can also be added here. When using Third Party Logistics (3PL) Providers, those costs might come as a package with the storage space costs and can be quite straightforward to determine.

Inventory risk costs cover essentially the risk that the items might fall in value over the period they are stored. This is especially relevant in the retail industry and with perishable goods. Risks first include shrinkage, which is basically the loss of products between the purchase from the suppliers (i.e. recorded inventory) and the point of sale (i.e. actual inventory), caused by administrative errors (shipping errors, misplaced goods, …), vendor fraud, pilferage and theft (including employee theft), damage in transit or during the period of storage (because of incorrect storage, water or heat damage, …).

For the reasons mentioned previously, it is hard to give more precise estimates.

Let’s simply say that for the categories mentioned above, the following estimates can be found in the literature:

- Capital costs : 15%

- Storage space costs : 2%

- Inventory service costs : 2%

- Inventory risks costs : 6%

This information has been extracted from https://www.lokad.com/definition-inventory-costs - special thanks to the authors)

The primary objective of this formulae for calculating inventory cost is to avoid any further cost of extra storage and ensure optimum cash flow. The system also ensures high accuracy so no additional costs are expected in the process.

An efficient system of risk management via the reduction of inventory costs through efficient logistics solutions greatly enhances the management of risk at Broström.

This coupled with an accurate system of calculating inventory costs ensure the process is error-free.