Shipping and logistics companies explain their business world as having two distinct eras: “Before GFC and After GFC (Global Financial Crisis). Everyone in these industries now see things in terms of “before” and “after” – that being before the year of 2008 and the start of the GFC and ever since then.

Whether it is the evaluation of balance sheets of major industry players, national growth figures or yearly results, there is rarely a financial figure published that does not demonstrate the fundamental shift that the shipping and logistics industry has faced ever since 2008.

The Contship Group is no exception. However, our industry reflects some of the primary indicators of on-the-ground economic activity and because Contship is Italy’s leader in container terminal logistics and intermodal solutions, we can clearly see some positive developments.

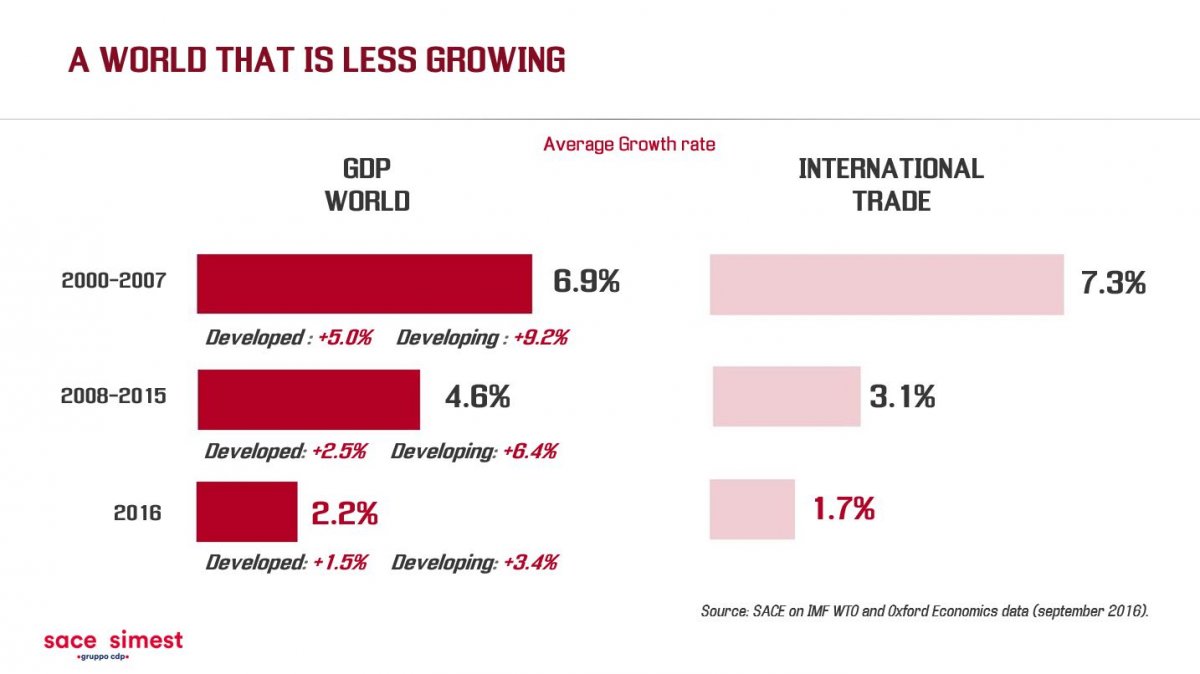

At a time when international trade has been slowing and does not act as a boost for throughput figures at ports and rail terminals anymore, there is a different driver for economic growth in Italy, as Sace Simest, (an institution that offers Italian enterprises specific tools for the internationalisation through insurance and financial products such as export credit, investment protection, financial guarantees, surety bonds and factoring. - http://www.sace.it/en), has showed in a recent study.

In 2016, the growth rates deteriorated, and the worldwide GDP grew by 2.2% only. Developed countries achieved 1.5% growth and developing countries 3.4% growth. Therefore, international trade picked up by just 1.7%.

However, if we drill down in these figures more closely and focus on Italy, there is an interesting development in terms of the growth of the national GDP.

The four components that mainly drive the growth of any national gross domestic products are personal consumption, investments, government expenditure and net exports. Whilst the first three factors together did not contribute much to the positive development of Italian GDP in 2015, net exports were revealed to be the main driver of the Italian growth.

Net exports from Italy have steadily climbed and we believe this is a trend which is set to continue.

There is clearly a silver lining in Italy post GFC. Of course, we realise a return to pre GFC GDP levels may take a while longer. However, it is important to keep in mind that much of Italy’s GDP growth in the 2000-2008 period was fueled by money that was relatively easily available as well as historically low interest rates.

Contship believes this export led growth we are now witnessing is more sustainable and long term. The Italian economy is changing with more flexible regulations and government policies designed to assist exporters rather than hinder them.

_2dd1e.jpg?itok=ifBfx9Tc)