China’s foreign direct investments in Europe continue to grow, while the european response to the belt and Road initiative is still fragmented. Foreign acquisitions of strategic supply-chain assets bring new development opportunities, but also new concerns for European policy-makers.

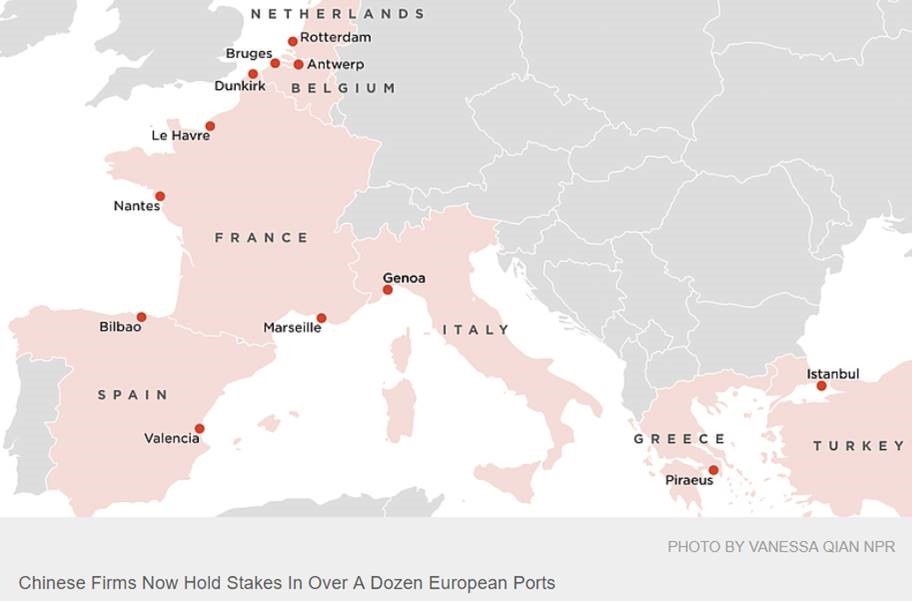

In the past decade, Chinese companies have acquired stakes in 13 ports in Europe, including in Italy, Greece, Spain and, most recently, Belgium, according to a study by the Organization for Economic Cooperation and Development.

Those ports already handle about 10% percent of Europe's shipping container capacity. It is part of China's 21st Century Maritime Silk Road (Belt & Road Initiative), which aims to better connect the country to commercial hubs in Africa, Asia, Europe and Oceania.

China is the European Union's biggest source of imports and its second-largest export market, adding up to more than $1 billion in trade per day. And sea shipping outweighs rail or air freight.

EU nations have long seen China as one of the most important trading nations and have gone to great lengths to encourage two-way trade. Historically countries such as Germany, France and the UK have opted for investment in China across a diverse range of sectors. But in more recent times the relationship has seen China invest in the EU on a large scale.

China’s focus on infrastructure projects has seen it invest extensively in European ports and the strategic focus of that investment has been on southern ports rather than in northern destinations.

COSCO, with the world's fourth-largest container shipping fleet, is leading the charge in Europe, beginning with Piraeus.

In 2016, after years of investment, the company bought a majority stake in the Piraeus Port Authority in a concession agreement that runs until at least 2052. It is now in charge of container terminals, cruise ship piers and ferry quays.

In Italy Chinese interests have acquired a stake in Vado via APM. And Chinese appetite for Italian investment seems to be increasing.

They have also bought brands such as tyre manufacturer Pirelli and machine-tools maker Cifa. Chinese funds invested in strategic Italian energy entities such as Eni, Enel and the Italian national electricity agency CDP Reti (China State Grid acquired a 35% stake). And Chinese investors purchased shares in Fiat Chrysler (cars), Ferretti (yachts), Telecom Italia as well as world-famous fashion designer Ferragamo. Chinese investors have also bought hundreds of Italian small and medium businesses.

Italy recently appointed a former Shanghai-based finance professor, Michele Geraci, as its undersecretary for economic development. Mr Geraci has is a supporter of Chinese investment and has suggested that Italy could become “China’s friend in the Mediterranean.” Among other ideas, he wants to work with China on its payments technology including through Tencent’s WeChat service, and on joint ventures in Africa.

The EU is currently working on a new framework for screening foreign direct investments (FDI). Ports represent the cornerstone of the EU trade infrastructure, as 70% of goods crossing European borders travel by sea.

China has long regarded the southern and eastern European regions as strategic and it is now starting to strongly link its overall investment in ports and terminals in the region into its Belt and Road Initiative. Aside from its port investment in Greece, China plans a network of railroad connections from the port to the western Balkans and northern Europe.

Though the port of Rotterdam will likely maintain spot as the busiest port in Europe, many analysts agree that the Chinese believe the southern European ports will become more central to east-west seaborne upon the completion of more Belt & Road projects.

New cargo routes will require new storage and shipment centres and will bring more business to south-eastern Europe. The Land-Sea Express Route, in conjunction with other Belt and Road projects, is set to enhance the role of southern and eastern European countries in the continental trade routes. The Southern Gateway Alternative is becoming a reality thanks to wider Chinese economy policy as reflected in the Belt & Road Initiative.

The scale of China’s investment and the long term nature of its strategy means the EU will take its time to formulate a united response to initiatives like Belt & Road.

To date, only 11 EU Member States have officially joined the project. It is fair to say that most European nations recognise the increasingly important political and economic relationship between the EU and China, but while France and Germany have generally been a little cautious, Italy, Greece, Spain and Portugal have openly welcomed Chinese investment.

China maintains close ties in its 16+1 framework of cooperation with 16 central and eastern European countries, all of which are either EU Member States or official EU candidate countries.

This article is part of CS WINdow, Broström Tankers AB's quarterly newsletter, featuring insights on the global supply chain, with a focus on European intermodal logistics. You can subscribe to learn more: